On Friday, US markets had their worst day since the summer of 2019. The S&P 500 Index fell 1.8% and the Dow fell 2.1% by the end of trading. The obvious cause is 2019-nCoV: the coronavirus that traces its roots to the city of Wuhan in China.

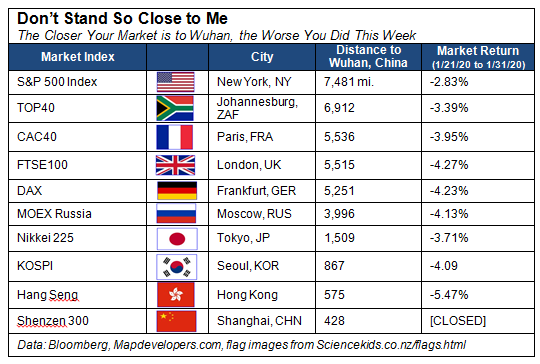

Some market analysts are claiming that geography is playing a more distinct role than in other crises. I’ve seen this table pop up a few times on my feed:

It might seem like common sense that in instance of a viral epidemic, geography would have a key role to play in global finance. After all, you can’t get sick from a virus if you’re not near it. But this is a loose correlation, at best. For one, the above graph takes no consideration of existing cases within these geographic subdivisions. Surely the spread of a virus by boat or airplane is a more valid metric than pure as-the-crow-flies distance. No one from Wuhan is crossing the Chinese border into Russia and going to Moscow directly. For two, companies listed on these indexes are global. Amazon, for instance, is listed in the S&P index and has a major supply interest in the Chinese market. For reference, Amazon’s beat on earnings pushed them over 2,000 points this past week.

Better, I think, to track real value lost as part of the ongoing crisis. I’ve attempted to do this below using market cap as a stand-in for dollar value.

| Market Index | City | Distance to Wuhan (miles) | Market return (in dollars) |

| S&P 500 | New York, NY | 7,481 | -789B |

| TOP40 | Johannesburg, ZAF | 6,912 | -25.7B |

| CAC40 | Paris, FRA | 5,536 | -80B |

| FTSE100 | London, UK | 5,515 | -122B |

| DAX | Frankfurt, GER | 5,251 | -68.5B |

| MOEX Russia | Moscow, RUS | 3,996 | -10.6B |

| Nikkei 225 | Tokyo, JP | 1,509 | -100.7B |

| KOSPI | Seoul, KOR | 867 | -86.8B |

| Hang Seng | Hong Kong | 575 | -1.68T |

| Shenzen 300 | Shanghai, CHN | 428 | [Closed] |

As can be seen without the muddied percentages, the value lost over the period from January 21st to January 31st has less correlation to geography than to established highly-active, highly-global indexes, as is usually the case.

More interesting than that, is the domestic reports that came from the Fed this week. Economic data is suggesting stronger regional manufacturing trends, consumer confidence so-far appears unaffected by middle east tensions or the coronavirus, and fourth quarter earnings figures are crushing it. That makes it hard not to see motives behind the recent sell-off as something other than just fears about the cooling effect that coronavirus promises to have on growth. Instead, it seems at least plausible to me that the outbreak is simply taking the blame for a correction in stock prices that was overdue anyway given the strong run-up we’ve seen since the end of 2018.

All said, while there will certainly be economic attaches to the viral outbreak, especially in travel, the virus figures are beginning to indicate more of a sigmoidal (in contrast to exponential) growth vector. Coupled with positive news regarding shared government responses, this volatility is likely to become more subdued throughout the earlier part of February and cooler heads will prevail.

Now lets watch some football. Go Chiefs!